|

Jim Brown Audio Player

Getting your Trinity Audio player ready...

|

Monday, March 20th, 2023

Baton Rouge, Louisiana

ANOTHER QUESTIONABLE BAILOUT FOR BIG BANKS!

Well, here we go again. Big banks are “high-fiving” each other after they won big in Washington last week. We thought government regulators had learned an expensive lesson after the financial crash in 2008 that led to massive bailouts at taxpayers’ expense. Back then, the financial industry was allowed to carry on high stakes gambling with your money. And now, it’s déjà vu as the Biden administration has followed precedent set by the Trump regulators and reopened the casino doors.

Last week, the U.S. suffered the second- and third-largest bank failures in the nation’s history. This wasn’t supposed to happen. A slew of protections were put in place after the financial crisis 15 years ago to prevent a repeat of big banks collapsing. A law titled Dodd-Frank required banks not to engage in risky investments that were backed up by taxpayers. “Go ahead and gamble on high-risk investments if you want, but don’t expect a bailout,” so the logical reasoning went.

Former Louisiana Senator David Vitter also passed legislation in 2012 that raised the cushion against bad risk by requiring more reserves. This was an important step in saying that we’ve had enough of corporate bank welfare. This legislation reduced the risky financial behavior of “heads banks win, tails, the taxpayer loses” bank mentality. But the question is, why did federal regulators ignore their obligation to hold these big banks accountable?

Here’s the kicker. Bank deposits are only supposed to protect investor’s deposits up to $250,000. But the Biden regulators announced that all deposits would be protected. So billions of dollars will be paid out to big investors and corporations. The message is clear. Don’t worry about how and where you invest or how risky the investment. The government will bail you out and you will lose nothing.

And get this. The largest bank to go under, Silicon Valley Bank, paid out bonuses to employees just hours before regulators seized the failing bank. How brazen can you get?

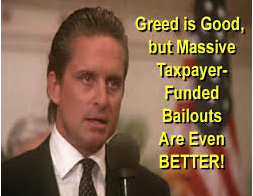

In the movie Wall Street, Michael Douglas’s character Gordon Gecko summed up the attitude of major U.S. banks quite well: “Greed is good.” And this certainly appears to be true, at least for the big banks. Because after all, the federal government has made it clear that even after the 2008 financial debacle, where hundreds of billions of dollars were poured into the likes of these big guys, there always seems to be a way around the regulations that are supposed to protect the taxpayer.

The old axiom is true. The more the big banks take irresponsible risks and commit out-right fraud, the more things stay the same, as the regulatory system looks the other way. Bank regulators say there will enforce these new strict public protections. That is until big banks face major losses and cry for help. Then the federal dollars begin to flow, and bailout checks pour out of the federal treasury with the force of a flooding river.

Thomas Jefferson was perceptive in what is said 200 years ago: “I believe that banking institutions are more dangerous to our liberties than standing armies.” I wonder what he would have to say about the current bank defaults if he were here today.

So although America has had enough of Wall Street and big bank welfare, taxpayers are the losers again. And it also looks like we could be hearing the 1930s song, “Brother can you spare a dime.” But with different words this time.

Once I was a banker, it was such fun-sold risky investments by the million.

Once I was a banker, now it’s done. Brother, can you spare a billion?”

Peace and Justice

Jim Brown

Jim Brown’s syndicated column appears each week in numerous newspapers throughout the nation and on websites worldwide. You can read all his past columns and see continuing updates at http://www.jimbrownla.com. You can also listen to his regular podcast at www.datelinelouisiana.com.